- The Connected Advisor

- Posts

- The Dawn of the Anti-Social Network: Apple's AR/VR and the Future of Wealth Management

The Dawn of the Anti-Social Network: Apple's AR/VR and the Future of Wealth Management

We also discuss where you work, the future of org charts and more

So much for summer slowing things down.

This week may have been one for the record books with relevant news and updates in our industry and abroad.

This week’s issue breaks down the following:

Upcoming Event - The Fractional Future of Wealth Management Today’s emerging leaders are going to deep dive on how firms are finding an edge in fractional places.

Should your Org Chart have a CTO? Kyle Van Pelt discussed this concept at length as well as what firms need to be focusing on as they seek growth.

The Dawn of the Anti-Social Network: Apple's AR/VR and the Future of Wealth Management. How should our industry think about the rapid advancement of VR and what can we practically do? I break this down and share some music along the way.

Sequoia meets a saw. Sequoia Capital moves into the three unique companies. Is this a model of what is to come for large RIAs?

Solving the Remote / Hybrid / In-Office Issue We take a look at how leaders need to really be thinking about where you work.

Welcome to this week’s connected. Lets go!

The Fractional Future of Wealth Management

Don't miss this opportunity to join industry leaders Diana Cabrices and Kyle Van Pelt as they delve into the transformative concept of fractional team membership. Discover how this innovative approach can revolutionize your organizational structure by integrating top-tier experts into your team, empowering your firm to scale more effectively and enhance your unique value proposition.

This webinar is designed to provide practical insights and actionable strategies that you can immediately implement in your firm. Whether you're looking to optimize your current operations or explore new avenues for growth, this session will equip you with the knowledge and tools you need to succeed in today's dynamic business landscape.

Join us and take the first step towards a more efficient and value-driven future for your firm. Your journey towards organizational transformation begins here.

Register by clicking the link below.

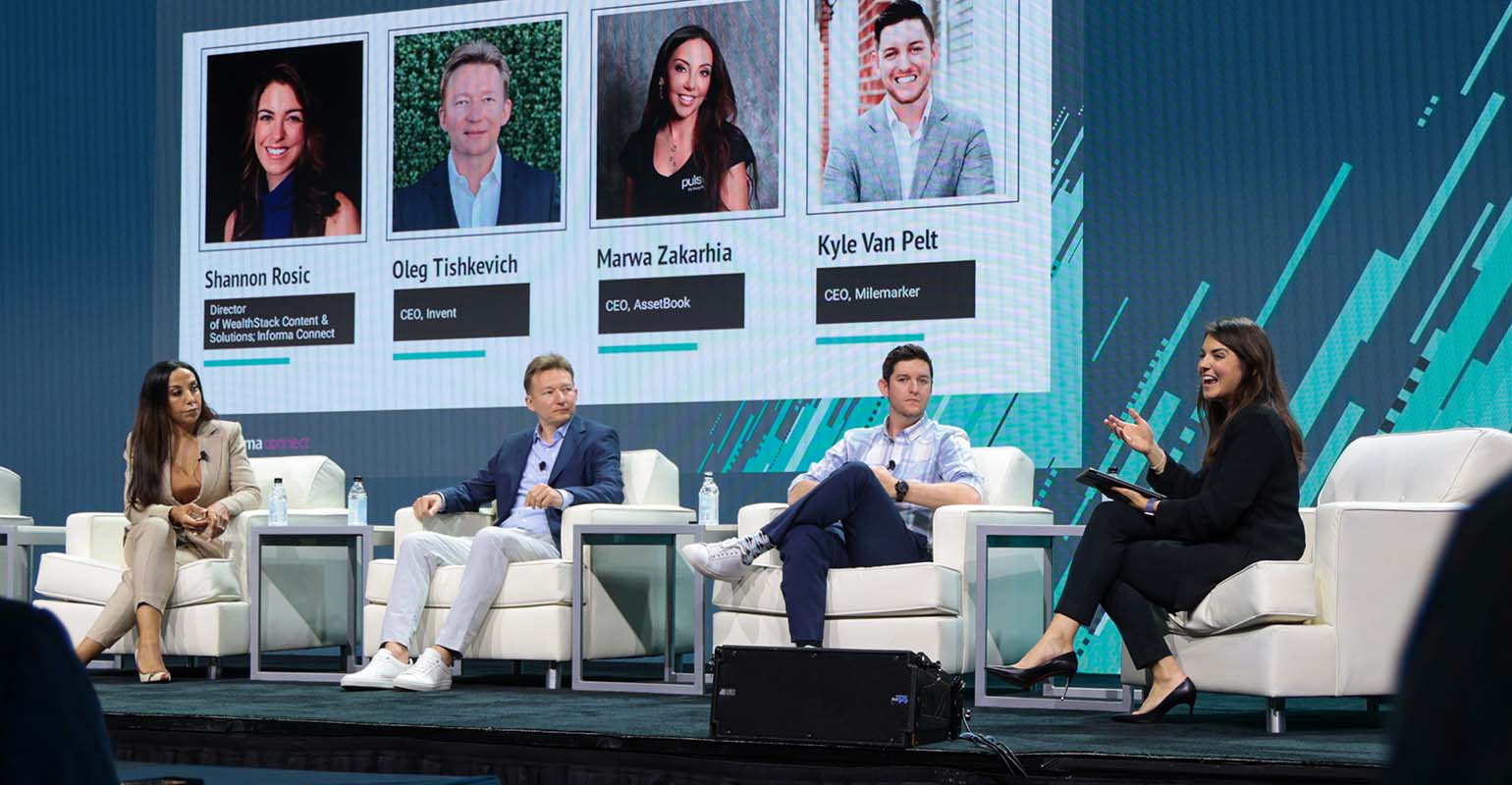

The Conference Circuit

Milemarker’s CEO, Kyle Van Pelt, hit South Florida to confront whether RIA’s need a CTO.

Through his talk, there were a number of key points that he discussed as it relates to the decisions and perspectives that RIA leaders have and likely need to challenge.

Fear of Tech Overhaul: Many advisory firms are hesitant to revamp their tech stack due to concerns about the time and effort required, and the potential impact on staff and clients. This fear is causing them to miss out on innovative technologies, according to Milemarker CEO Kyle Van Pelt.

The CTO Dilemma: While managing technology can be overwhelming for firm CEOs, the burden often doesn't justify hiring a full-time CTO or internal software engineers. Van Pelt emphasizes that advisors should focus on their core role and not be expected to take on the responsibilities of a CTO.

Tech Integration Challenges: The process of managing technology integration both within and outside firms is inefficient. Every firm is trying to create a unique experience for clients and advisors through technology, leading to repetitive work and increasing workloads.

The Need for Accessible Tech Solutions: The long-term challenge is to create tech solutions that are accessible for CEOs who can't hire a CTO but still have unmet technology or integration needs. Van Pelt warns against underestimating the difficulty of making drastic changes to technology systems.

Focus on Client Engagement: The focus on "all-in-one" tech solutions often overlooks the client engagement experience. There's a need for technology that helps advisors engage their clients more efficiently.

The Dawn of the Anti-Social Network: Apple's AR/VR and the Future of Wealth Management

When the Social Network hit the screens, it wasn't just a cinematic success. It was a cultural phenomenon that signaled a shift in our world. It took us on a journey of the evolution of a mainstream technology - Facebook, its inception, its creators, and the collateral damage along the way.

Today, we stand at a similar precipice.

We are witnessing the dawn of the anti-social network. With AI providing solutions that we once relied on humans for, and the normalization of VR/AR, we are nearing a time when the world is turning over once again. As financial advisors, we must adapt to this new reality.

On June 5, Apple debuted its long-awaited response to the metaverse with the Apple Vision Pro goggles. Priced at $3500, this VR set might seem like a novelty for now, but knowing Apple's deliberate nature, it's likely to go mainstream in the next 3-5 years.

This brings us back to a scene from the Social Network where Sean Parker (Founder of Napster and an early member of Facebook) tries to interact with a developer who was “wired in.” Today, we are openly discussing other universes, and the idea of someone next to you being far away from you will become increasingly standard.

I would also add that the soundtrack by Trent Reznor and Atticus Ross is one of my all-time favorites. In fact, this article may be better with this soundtrack.

So, what does this mean for Wealth Management and the Role of Advisors?

The question isn't about any specific device. It's about the evolving expectations of investors now and into the future.

Today, your clients can get far better insight from their personal devices than most advisors can ever hope to provide. The most cutting-edge client experience might not turn your clients' heads compared to what they can get on their watch, phone, iPad, or goggles.

That said, they need very real guidance and support the growing complexity of what is to come.

Since the Industrial Revolution people have looked at new eras of advancement with a sense of Automation Anxiety.

Joseph Schumpeter is often cited for his theory of “creative destruction.” This theory suggests that innovation in capitalism involves the destruction of old structures and the creation of new ones.

This destruction often involves companies and organizations destroying jobs/roles and creating totally new roles.

We see this today in many of the fastest growing firms.

Instead or hiring another operational employee, companies are investing in automation and workflow to provide the business scale that was simply unachievable before.

Rather than having a team that was completely in house, companies are becoming more reliant on competent contractors and third parties that are wholly focused on a specific discipline that can evolve as a far different pace.

Quite simply, the fastest growing companies are the fastest changing companies.

None of us wants our firms to be leading a team of horse carriage operators in an automobile era. So how do we take key steps to modernize our businesses so we can in turn modernize the experiences we deliver to our clients?

Invest in Innovation - Your team should have a spirit of excitement when it comes to technology and change. It is important to inspire intellectual curiosity and provide the freedom for your team to experiment.

Own Your Data - If you want to be able to deliver the insights you need for the future, you need to have the ability to access all of your past, present and future data.

Enable Your Analytics - The chances are you have a Business Intelligence tool laying around. The problem is, its laying around. You need to put it to work. Start to harvest rich analysis on the items that are important to all the areas of your business.

Dashboard Your Clients - Imaging your client is a business (some of them may actually be), what information would you want them to see with one glance each day. Start to piece this together so that you can begin to speak a language that helps better transform their lives in an optimal way.

Create Your Command Center - If you were to really get wired in on how your business needs to improve, you will likely identify the key factors that impact that improvement the most. What’s stopping you from creating a command center that presents the key data that reflects your business, your client experience and your areas for improvement so that you can focus on optimization?

Let me know if any of these items are helpful to your firm.

Also, feel free to share your favorite soundtrack.

Highways and Byways. Quick Takes on Industry News.

Sequoia Capital’s Global Split. Is it a Leading Indicator for an Era of Deconsolidation?

The largest VC is splitting into three. Is this an indicator of how the largest wealth management companies may trend in the years to come?

Here’s the skinny:

Sequoia is splitting into three entirely different firms: Sequoia Capital representing the U.S. and Europe, HongShan in China, and Peak XV Partners in India and Southeast Asia. The separation is planned to be completed no later than March 2024.

The decision to split Sequoia's global brand was influenced by conflicts between the funds' respective startup portfolios, brand confusion as they diverged in strategies, and the increasing complexity of maintaining centralized regulatory compliance.

Despite the split, all three firms deny that geopolitical tensions were a specific catalyst for the move. Instead, they cite conflicts between their broadening portfolios as a significant factor.

The new firms will set up their own infrastructure, and partners will not invest in each other’s funds. Any profit sharing (as well as back-office functions) between the regional funds will cease by December 31.

This development in the venture capital world could serve as a case study for wealth management leaders, illustrating how a global firm can adapt to changing market conditions, manage conflicts of interest, and navigate geopolitical complexities. It also underscores the importance of maintaining a strong brand identity and diversification's potential benefits and challenges.

Is the Hybrid Office the Worst of Solutions?

David Heinemeier Hansson (DHH), the inventor of Ruby on Rails and cofounder of 37Signals, has thrown down the gauntlet, challenging business leaders to make a definitive choice in the ongoing debate between hybrid, remote, and in-office work models.

It feels like lots of firms are in all different places on this topic.

Personally, I've experienced all three models and found the hybrid approach to be the most perplexing. However, a fully remote model, punctuated by a 90-day retreat, seems to resonate with my work style the best.

Let me know where you are reading this from and I hope you have an excellent weekend!